There has been agitation over the non-payment of royalties (see here for example). In the discussion around the furore, royalties and project development levies are deemed to be part of the benefits from the massive PNG LNG project. For instance, Loi Bakani, Governor of the Bank of Papua New Guinea, in a 2015 statement advised that “[in] addition to royalties and development levies the State is directly benefiting from the PNG LNG project through equity dividends … and direct and indirect taxes” (see here).

Whilst Bakani points out that the royalty and development levy benefits arises as a consequence of the PNG LNG Project, it does not give cognizance to the fact that the costs of these are not actually fully borne by the project.

The value of royalty benefits from resource projects is considerable. The PNG Chamber of Mines and Petroleum on its website (see here) outlines benefits from resources projects include: “company tax, royalty, dividend withholding tax, salary and wages tax, duties, production levy”. The Chamber then states that the industry it represents (before the PNG LNG project started producing) paid “K1.3 billion in royalties … from 2005 to 2010”.

However, it is the people of PNG that are effectively paying the royalty to the PNG LNG landowners and a significant share of development levy that goes to the PNG LNG provinces.

[adinserter block=”1″]

What is a gas and oil royalty?

Royalty payments are made to the minerals and petroleum resource owner for the right to extract the resource. The term royalty payment has its genesis in the history of England when their Kings were the ultimately owners of land and granted rights to the use of their land for a return of his “royalty” as a share in the profits.

The Papua New Guinea Extractive Industries Transparency Initiative Report 2013 (see here) points out that according to the “…Oil and Gas Act, subsoil assets belong to the State” (page 38).

Whilst a label of royalty may be applied to this benefit stream it is anything but. Papua New Guinea does not have a true royalty system for the PNG LNG project as it is not the developers who exploit the gas resources that bears the burden of royalties but the taxpayers of Papua New Guinea.

Legal framework

The Organic Law on Provincial and Local Level Government (section 98) sets out the legal basis for development levies and states that that an Act of Parliament shall provide details for its application. For the petroleum sector this law is the Oil and Gas Act (sections 2 and 60).

The legal basis for royalty payments is provided for in the Oil and Gas Act (section 159).

For both benefits the value is equivalent to 2% of well-head value of oil and gas extracted. A regulation made under the Oil and Gas Act sets out the precise calculation, which allows certain deductions to the gross value of hydrocarbons extracted. The Tax Review Committee proposed a change to the method of this calculation (Final Report, Volume 2, page 103).

“The hardest thing to understand in the world is the income tax” – Albert Einstein

Under the Oil and Gas Act both royalties and development levies can be claimed as tax deductions. If, as in the PNG LNG Project, both are paid then the royalty can be claimed as a tax credit. This can be confirmed on the IRC website (see here).

For the PNG LNG Project, and generally, the company income tax for each project participant is determined by taking its gross income subtracting any exempt income and allowable deductions and multiplying this against the applicable tax rate, which is 30%. If there are any tax credits this is then offset to give the income tax payable.

The PNG LNG Project has secured fiscal stabilization but was not required to pay an additional company income tax rate of 2 percentage points for this as required under the Resource Contracts Fiscal Stabilization Act. That is a company income tax rate of 30% is applied though normally it would be 32% with fiscal stability. Fiscal stability is protection given to the project by the government that the fiscal regime (the applicable taxes especially) for the project will remain unchanged.

So a tax deduction delivers a tax saving for the project participants of 30 toea for each K1 of the total amount of allowable deductions whilst a tax credit delivers complete tax savings of the corresponding amount of the eligible tax credit expenses. These amounts are offset from their tax bills.

So let’s put this into perspective for these are large valued benefits. For example, Bakani advised (see here) that there was an accumulated amount of K108 million in royalty payment to landowners of the PNG LNG Project as at September 2015. Bakani further advised that the first development levy payment of K73.8 million had been made on 27 March 2015. Since then with continued and uninterrupted oil and LNG production the cumulative amounts of the benefits will have increased.

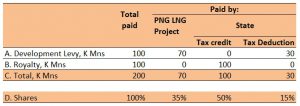

Let’s for the purposes of illustration examine how each K100 million of both benefits work with the tax system. You can choose any hypothetical amount you wish but remember that the value of both benefits are computed the same way and will be the same at any given moment.

Now I pose the question: Who is actually bearing the first round cost of these benefits that are made to those fortunate project landowners and project provinces? There is an incorrect perception that the costs of the royalty and development levy are wholly borne by the PNG LNG Project – this is not the case.

Exhibit 1

Source: Author’s calculations

Tax credits and tax deductions are what are termed “tax expenditures”. Tax expenditures have first call on budget revenue as these imply foregoing revenues that would have otherwise come to the government to be available for funding for priority areas for our people. There are a number of advantages of tax expenditures as there are a number of drawbacks – I leave that discussion for another day.

[adinserter block=”1″]

Exhibit 1 shows that the State, which is effectively the taxpayers of Papua New Guinea:

- bear the burden completely (that is 100%) of the cost of the royalty;

- bear the burden of 30% of the cost of the development levy; and

- bear the burden of 65% of the combined cost of the PNG LNG royalty and development levy.

For each K100 million of development levy paid by the PNG LNG project co-joint venturer companies, they can claim K30 million as a tax deduction. For each K100 million of royalty paid by the PNG LNG project co-joint venturer companies they can claim K100 million as a tax credit. These are amounts that will be offset from their tax liability.

Whilst each K200 million paid by the PNG LNG project imposes a cash flow burden on the project it is more than offset by the saving of K130 million it receives on its tax bill. So the project effectively only pays K70 million for each K200 million of both benefits.

So who then foots the bill for the K130 million? It is the Government!

Where does the Government get its income from ultimately? Taxpayers!

There is a gross unfairness that is imposed on Papua New Guineans that aren’t from the “gas provinces”.

So whilst we spare a thought for those landowners that await in frustration the payment of their royalty, we should also spare a thought for the tax payers of Papua New Guinea who are effectively paying for the complete cost of these royalty payments and 65% of the combined amount of royalty and development levy.

The resource tax legislation needs to be reviewed by the incoming government to endure that PNG receives maximum benefit from the extraction of its non-renewable natural resources. We certainly do not want to become like resource-rich African countries that are now facing poverty because of exploitation by foreign multinationals in the name of resource development.

Thanks for your comment. I agree we should not repeat the mistakes of the past and where possible correct them.

We cannot do much about the fiscal regime granted to PNG LNG project because of the fiscal stability agreement the State has signed with the project owners. Should we be concerned? On balance, maybe not as this project was big enough and a game changer to warrant a “little” more favourable treatment.

Going forward the plan should be to ensure we continually improve the terms of agreements with new resource projects in favour of our country and our people. The PNG LNG project is eyeing a third train and there is question as to whether an expansion opens the door to the State to negotiate better fiscal terms. We should be looking at this possibility seriously.

The aim of my post was to shed light on who actually pays for the cost of the PNG LNG royalty. It is not the project. It is our people that pay taxes (directly) and our people that don’t receive much needed goods or services (indirectly through a smaller revenue budget). This raises a larger question of equity and fairness that is central to politics – how do we want to distribute the resources of our country in a manner considered just and fair.

To get a holistical picture of the project benefits,it would be good to also consider what the oil and gas agreements say about (a) national content / contract to local businesses (b) training and employment and (c) Infrastructure projects, a socio economic assessment of the impact of these indirect benefit streams to the local, regional and national economy should be considered. Whilst it is good to consider the direct benefits like royalty (which landowners tend to focus on) it’s the indirect benefit that create the greatest value I find, however it’s always then up to the government and people to maximize on these opportunities.

Thanks for your comment and good observations.

The key message of my post was that the LNG royalty is not in fact a PNG LNG Project benefit in that it is not a cost paid for by the Project. The cost is actually paid for by the taxpayers of Papua New Guinea. So when you total up the direct and indirect benefits you would not include royalty payments.

Dependent on oil prices, the total nominal value of royalty payments over the 30-year life of the Project could easily reach K3-4 billion. The question for Papua New Guineans is should this be paid for by taxpayers of Papua New Guinea or by the Project if this is truly supposed to be a royalty?

Interesting… I believe all PNGeans are of the assumptionn that the project pays the royalties directly.

This arrangement needs to change.